Key Highlights

- LVNV Funding, LLC is a debt buyer. They purchase unpaid debts from other companies for a fraction of the amount owed. They then try to collect on those debts to earn a profit

-

Once a debt has been purchased by LVNV Funding, LLC, they (or their collecting arm, Resurgent Capital Services) try to collect on that debt by sending letters, making phone calls, and filing debt collection lawsuits

- If you’re receiving calls or letters from a debt collector at LVNV Funding, LLC or Resurgent Capital, there are rights that protect you and actions you can take like settling the debt, disputing the debt, or responding to a LVNV Funding, LLC lawsuit

Tired of debt?

Rise above debt without the hassle of bankruptcy. Request your free consultation below.

If you’ve received a letter or lawsuit about a debt owed to LVNV Funding, LLC, you probably some questions.

What is LVNV Funding, LLC?

How do they operate?

Can I settle a debt with LVNV Funding, LLC?

In this article, we’ll answer all those questions and more. We’ll explain the relationship between LVNV Funding, LLC and companies like Credit One Bank, Resurgent Capital Services, and Credit Control, LLC. Then, if you owe them money, we’re going to explore your options and touch on dealing with debt collectors in general. So, read on for all the information you need to know about settling debt with LVNV Funding and their affiliated companies.

Who Is LVNV Funding, LLC?

LVNV Funding, LLC is a debt buyer. That means they purchase unpaid debts from other companies for a fraction of the amount owed. They then try to collect on those debts to earn a profit. So, naturally, their goal is to buy low and collect high.

LVNV Funding, LLC is one of the largest debt buyers in the United States, so it isn’t uncommon to see their name when you have accounts fall behind and go to collections.

Once LVNV Funding, LLC has acquired a debt, they have a few options that they can exercise right away or in the future. To name a few, they may:

- Collect on the debt directly

- Hire a third-party collection agency to pursue collections

- Place the account with a law firm for collection and/or litigation

- Do nothing

- Resell the account to a different debt buyer

One thing to keep in mind is that LVNV Funding, LLC is not a lender and they do not directly collect debts they purchase. Because of this, the collection activities of the consumer facing collecting entity- Resurgent Capital Services- are subject to the Fair Debt Collection Practices Act. The FDCPA is a series of laws that protect consumers from unfair tactics by debt collectors.

Is LVNV Funding, LLC a Legitimate Debt Collection Company?

Yes, LVNV Funding, LLC is a legitimate company. LVNV Funding, LLC is one of the largest debt buyers in America.

Just because they are a legitimate organization doesn’t mean you should let your guard down. We are a consumer rights law firm, and we encourage you to treat any call or letter asking you for money with a healthy amount of skepticism. The scammers of the world are known to piggyback off of other companies. Double and triple-check to be sure you are truly communicating with the real LVNV Funding, LLC before providing any personal information and falling prey to a scam. If it truly is a call, letter, or lawsuit from LVNV Funding, LLC, they are indeed a legitimate debt buyer.

What Is the Relationship between LVNV Funding, LLC, Resurgent Capital Services, and Sherman Financial Group?

There are several entities working with LVNV Funding owned debts. For example, when you have a debt that has been purchased by LVNV Funding, you may also see Resurgent Capital Services, Sherman Financial Group, or Sherman Acquisitions.

With all these companies intertwined, it can get a bit tricky.

Rather than untangle the corporate web behind LVNV Funding, LLC, suffice it to say that Resurgent Capital is the front-line collection agency, LVNV’s name is on most of the credit reports and paperwork, and Sherman Financial Group and Acquisitions tend to stay behind the scenes.

What Is the Relationship between LVNV Funding, LLC, Credit One Bank, and Other Creditors?

LVNV Funding, LLC purchases unpaid debt from lenders like Credit One Bank, SoFi, and others.

Once a debt has been purchased by LVNV Funding, LLC, it is their right (or that of their collecting arm, Resurgent Capital Services) to try to collect on that debt. The original creditor no longer owns the debt, and all communication regarding the account will take place between you (or your debt settlement attorney) and the new owner of the debt or their collector.

Why is LVNV Funding, LLC on My Credit Report?

When LVNV Funding, LLC becomes the new owner of your debt, their name will often appear on your credit report alongside the collection account. Their remarks may include their contact information, how long the account will remain on your credit report, and the account status, such as unpaid, paid in full, or settled.

Under the Fair Credit Reporting Act, they are able and expected to report accurate and verifiable information. If it is not accurate, or they cannot verify the information, you may be able to remove LVNV Funding, LLC from your credit report by disputing the remark.

What Should I Do If I Receive a Letter or Call from LVNV Funding, LLC?

If you’re receiving calls or letters from a debt collector at LVNV Funding, LLC or Resurgent Capital, there are actions you can take and rights that protect you as a consumer in debt.

First, read the Attorney’s Guide to Reading a Collection Letter. This will explain the core elements of the letter you received and the laws that collection agencies need to follow when sending letters about collection accounts.

Then, determine your next steps.

Are you sure you owe the alleged debt to LVNV Funding, LLC? If not, you might consider sending a debt validation letter. With a bit of research and legwork, you can attempt to do this on your own. If you’d like a free consultation with a law firm familiar with disputing debts, contact our team here at National Legal Center.

If you are sure the debt is valid, can you afford payments to resolve or settle the account? Make sure any arrangement is affordable and doesn’t leave you falling behind on other obligations.

National Legal Center negotiates with companies like LVNV Funding, LLC, and Resurgent Capital Services every day. Complete this short form to discover options to resolve debt with LVNV Funding, LLC, and any other creditors you may have on your credit reports.

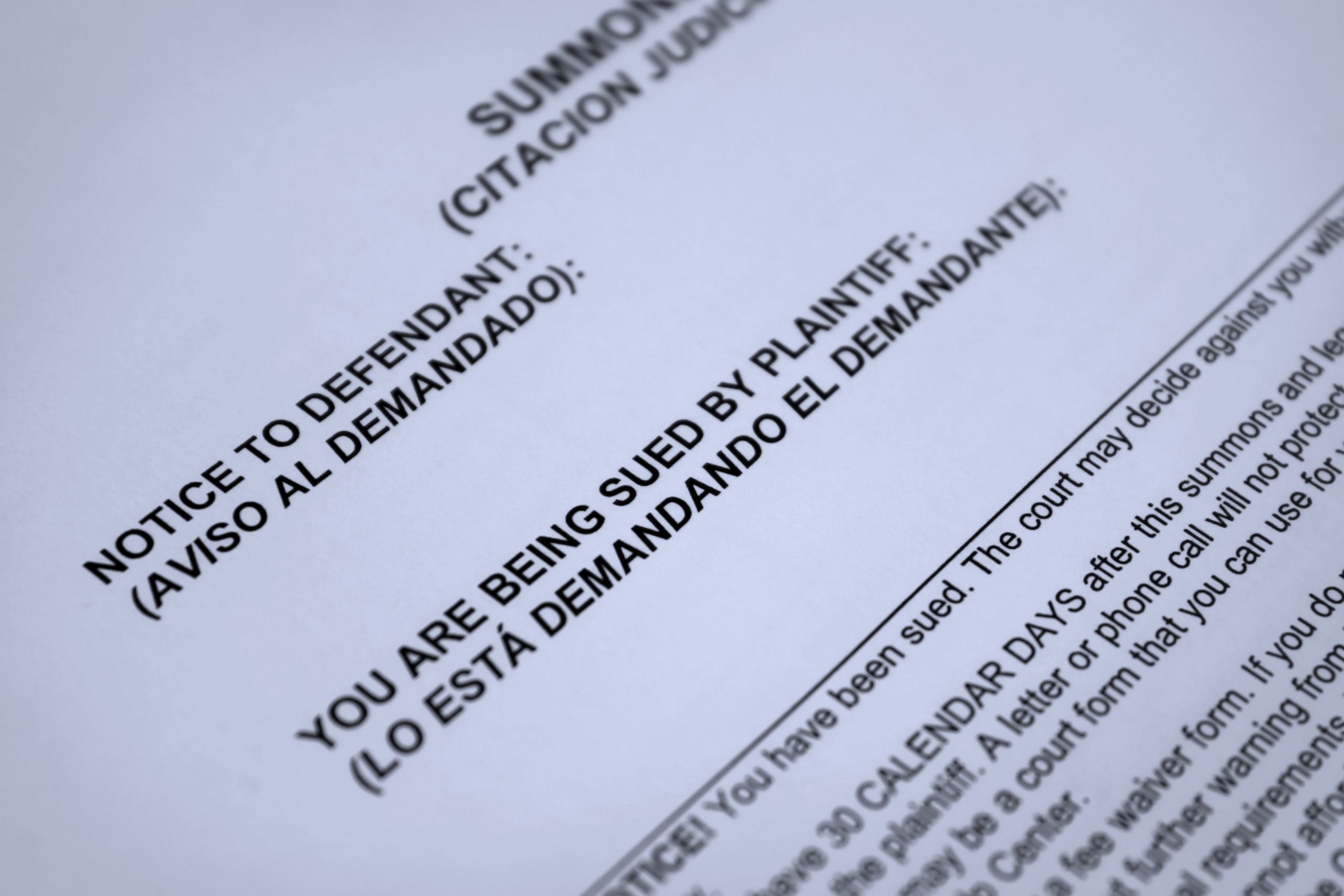

Can LVNV Funding, LLC Sue Me?

Yes, LVNV Funding, LLC may be able to sue you for the debt you owe. A debt collection lawsuit can be a frightening experience that you should not take lightly. If LVNV Funding, LLC sues you, it is important to seek legal assistance as soon as possible. National Legal Center offers a unique consultation specific to individuals facing lawsuits to discuss your case and determine the best course of action for you.

Should You Negotiate a Settlement with LVNV Funding, LLC?

When LVNV Funding, LLC is contacting you about a debt, one option to resolve the debt is negotiating a settlement.

A settlement is where you pay less than the total amount owed on the debt, either in a lump sum or over several monthly payments. Once you’ve paid the settlement, the account is reported to the credit bureaus as settled in full (or similar), and LVNV Funding, LLC should not take further action.

If LVNV Funding, LLC has filed a debt collection lawsuit and you’re considering settlement, things change a bit. Of specific importance is the timing of the settlement.

For example, if the settlement occurs after LVNV Funding, LLC issued a summons, you’ll want to make sure you know whether the court hearing was canceled. If not, you may still be expected to appear in court, even if only to share the details of the settlement.

If you settle an LVNV Funding, LLC lawsuit after a judgment was entered, you’ll want to have documentation that confirms they will file a satisfaction of judgment with the court.

While you can ask the representative at whatever law firm is handling the matter for LVNV Funding, LLC, it’s crucial to remember that they are not your attorneys!

Instead, they represent the other party, so it’s a good idea to be skeptical and confirm anything they tell you, because their job is to collect the most funds possible on the accounts they handle.

Negotiating a settlement is an excellent way to resolve a debt. Just make sure to cross your t’s and dot your i’s.

Tips for Negotiating a Settlement with LVNV Funding, LLC.

Here are some tips for negotiating a settlement with LVNV Funding, LLC. These suggestions apply to any other debt collector, too!

Here are some tips for negotiating a settlement with LVNV Funding, LLC, or any other debt collector:

- Negotiate a settlement you know you can afford. Don’t over commit yourself and fail to complete the terms of the arrangement.

- Obtain a letter outlining the terms of the agreement, including the amount to be paid and the payment due date.

- Follow the letter’s instructions. If the settlement agreement is $4,089.98, pay that, don’t pay $4,090! If it is due by the 28th, paying on the 30th doesn’t cut it —if you need an extension on a settlement, you also need a new letter.

- Maintain your documents. If the account surfaces in the future, you’ll be glad to have a copy of your settlement letter and proof that you paid it as agreed.

How Can a Debt Settlement Attorney Help?

Receiving a summons on a debt you owe to LVNV Funding is a serious legal matter. It can lead to a judgment, wage garnishment, a lien against your home, and more. Your best move is to consider hiring a debt relief lawyer to help protect your rights and ensure you aren’t taken advantage of or make a mistake during the legal proceedings.

If you decide to work with an attorney, they will likely take a look at your entire financial situation and work to find a resolution that is affordable for you and minimize your legal risks. They may also identify alternate legal strategies to deal with the debt.

Did you know a debt settlement attorney can help even if you’re not facing a lawsuit?

You don’t have to wait until you receive a debt collection summons to begin working on a solution. By working with a lawyer familiar with debt-related matters, you can minimize the chances of a debt collection lawsuit happening in the first place.

Can the Fair Debt Collection Practices Act Help with a Debt Collection Lawsuit?

A debt collection company often walks a very fine line when trying to get a consumer to repay a collection account. Most collection agencies are cautious about following the laws that oversee debt collections, such as the Fair Debt Collection Practices Act, Fair Credit Reporting Act, and other consumer protection laws. However, sometimes an untrained or unruly debt collector can violate your rights.

Among many other things, a debt collector may not:

- share inaccurate information during phone calls

- provide legal advice

- lie about what type of legal action they can take

- misrepresent the debt

- pursue time-barred debt without proper notification

- disclose your debt to third parties

If a representative of a debt collection agency has violated your rights and then you are facing a debt collection lawsuit, you may be able to file a counterclaim against them. A successful counterclaim on a debt collection lawsuit can lead to many outcomes. For example, it may result in dismissal of the lawsuit brought against you, a waiver of the debt owed, removal of the account from your credit reports, money damages to you, and more.

Contact Information for LVNV Funding, LLC

If you have an account that is owned by LVNV Funding, LLC, it helps to know how to contact them. To obtain confident contact information, you may want to go to the company’s website, your credit report, or the Better Business Bureau.

Below is the contact information for LVNV Funding, LLC as well as Resurgent Capital Services.

**Important**

At the time of this article’s publication, LVNV is requesting that all inquiries and communication be directed to Resurgent Capital Services. Be sure to verify payment instructions with any debt collection agency before making any payments.

LVNV Funding, LLC

Phone: (864) 248-8700

Fax: (864) 467-0163

Resurgent Capital Services

Correspondence Phone: 1-888-665-0374

Correspondence Address:

Resurgent Correspondence

PO Box 10497, Greenville, SC 29603

Payment Address:

Resurgent Capital Services

PO Box 10466, Greenville, SC 29603

Dispute and Complaint Address:

PO Box 1269, Greenville, SC 29602

Dispute and Complaint Email

Dispute & Complaint Phone: 1-866-572-0262

National Legal Center negotiates with debt buyers and debt collection agencies regularly. Complete this short form to discover options to deal with a summons from LVNV Funding, LLC and any other collections account you may have.

If you’re tired of struggling with debt, you’ve got options. Call today and let National Legal help you #standuptodebt once and for all.

Are you struggling with debt? Use the form below to get in touch with us.