An Attorney’s Guide to Reading a Collection Letter

An Attorney’s Guide to Reading a Collection Letter

Collection letters are a scary thing for most people. So, we’re bringing you a debt relief attorney’s guide to reading a collection letter. They can be intimidating and confusing to read, but not if you follow these simple steps! Once you understand what the creditor wants from you, you’ll be ready to #standuptodebt with confidence.

We’re diving in deep to show you exactly how to read a collection letter from start to finish.

Have a specific item you’re curious about?

Follow these quick-links to the attorney’s guide to reading a collection letter to get you right to your answer.

Let’s begin the attorney’s guide to reading a debt collection letter by looking at:

What Does “Current Owner” Mean on a Collection Letter?

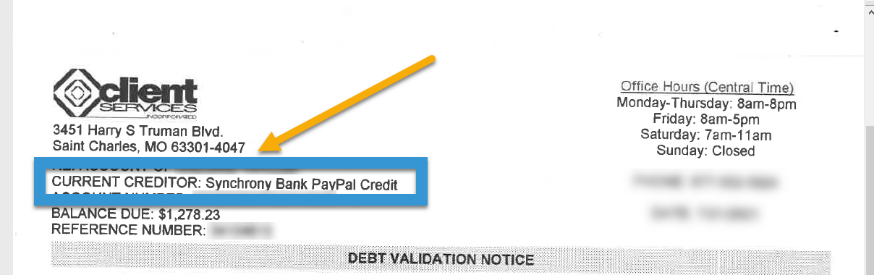

When you first look at a collection letter, you’ll notice a few things. Near the top you’ll usually see details about the account. This may include:

- whom you owe

- how much the claim you owe

- who the current creditor or dent owner is

- reference number

- invoice numbers

- the mailing address of the debt collection agency

First, we’ll dive in on the “current owner” portion of the details section. This may also appear as a “current creditor.” The terms can be used interchangeably.

What is a Current Owner or a Current Creditor?

If you have received a collection letter and are left asking yourself:

“What is a Current Owner/Creditor”

“Who is Midland Credit Management?”

“Who is Portfolio Recovery Associates?”

“Who is LVNV Funding?”

Or if you have some other company you’ve never heard of saying you owe them money—read on!

Who are these companies?

How could there be anything but the original creditor involved here?

Understanding the players involved will help you make informed decisions. In addition to understanding what a current owner is, we’ll also address how to know if you are dealing with a reputable company.

What is an Original Lender?

Before we jump into the current owner, let’s start from the beginning. The attorney’s guide to reading a collection letter is intended to be thorough, after all!

Among those details found near the top of a collection letter will usually be a reference to the original lender. The collection letter may also refer to the “creditor,” “lender,” or similar. Simply put, this is the company that you owed money to. This is the financial institution that initially issued the credit card, loan, or line of credit.

Examples include big banks such as Bank of America, Chase, or Discover, smaller local community banks and credit unions, and other lenders.

What is a Current Owner?

When someone falls behind on a debt, the account is considered “delinquent” or “in default.” A debt that falls behind goes through a rather expected lifecycle of delinquent debt.

One part of the lifecycle of delinquent debt is that the account may eventually be sold to a debt buyer. These are companies that purchase an inventory of delinquent debt for less than the total amount owed across all accounts. A lot less, according to the Federal Trade Commission.

Once they have purchased your debt, this debt buyer is now the owner of your account. Their goal is to collect as much as they can, on as many accounts as possible, to maximize their profit.

This company, the debt buyer who purchased your debt from the original creditor, is the “current owner” of the account. They have received the rights to the debt and can now pursue collections. They can attempt to collect directly, or they too can hire a third-party collection agency to collect on the debt.

Are They Legitimate?

If there is one thing the attorney’s guide to reading a collection letter wants to deliver, it is peace of mind. If you ever receive a letter from a company that is unfamiliar to you demanding money, pause! There are tons of scams out there, and they love to target vulnerable individuals.

If you have had debt trouble in the past, your debt may have been sold to a debt buyer. If the information regarding the debt is familiar to you, and you had trouble in the past, take it seriously, but confirm their credibility before paying.

If you are not familiar with the debt, or are not confident that this is a legitimate company attempting to collect on a legitimate debt, you have rights. You can research the company with a bit of online research. A bad BBB rating doesn’t mean they are illegitimate. Honestly, that is a bit expected for their industry.

Note that some types of debts, such as personal loans and payday loans, do have a higher tendency to attract scam artists. If this is the type of debt that the supposed collector is trying to collect, be extra wary.

If you still aren’t sure who this company is or are unsure that they’re legitimate, consider disputing the validity of the debt. You can do this on your own or with the help of an experienced attorney like you can find at National Legal Center.

Next in the Attorney’s Guide to Reading a Collection Letter:

What Does “Charge-Off” Mean on a Collection Letter?

Next, we’ll move on to another phrase often found when you read a collection letter.

Many collection letters will include the term “charge-off.”

Like credit reports, collection letters are full of terms that mean something other than what you might assume. Of all the odd terms found on collection letters, this one likely raises the most questions from clients receiving our debt resolution service.

So, what does “charge-off” mean on a collection letter?

Is it as bad as the collection letter makes it out to be?

Let’s take a look at that and also consider different perspectives based on your unique goals.

What Prompts it, and When?

The only time an account will charge off is if payments are delinquent.

Even if you are making partial payments, the creditor may charge off the account. Therefore, you need to make the minimum payment to avoid falling behind.

A charge-off will generally occur after about 180 days of non-payment. There may be some variation based on the type of debt, according to the FDIC. It can sometimes happen as early as 120 days after missing the first payment, but the 180-day mark is the normal timeframe for credit cards.

The Credit Bureau’s Perspective

Let’s start by looking at the way Experian defines it.

According to Experian, “Charge off” means that the credit grantor wrote your account off of their receivables as a loss, and it is closed to future charges. When an account displays a status of “charge off,” it means the account is closed to future use, although the debt is still owed.”

As you can see, this refers more to the creditor than the debtor.

Yes, a charge-off is considered a negative remark on a credit report. And, yes, it can affect the way the debt is collected. However, it more has to do with a creditor’s internal accounting.

Probably one of the most critical points their definition makes is that the debt is still owed.

The Collection Definition

Collection letters will often make statements such as “if you do not make arrangements to repay this debt, it may result in the account being charged off….”

They intend for this to sound scary.

It should come as no surprise that a collector will do whatever they legally can to collect on a past-due debt. Turning an accounting term into a scare tactic is just another example of how they tend to operate.

It can help to know that this is a normal part of the collection process.

That is worth repeating.

A charge-off is a normal part of the collection process.

In many cases, a charge-off can be helpful because the lender or any third-party debt collector that may become involved may be more willing to make a deal to resolve the debt.

Further, among the most helpful benefits of a charge-off is that it prevents late fees from continuing to accrue on the account. It may go without saying that this can be incredibly helpful when trying to get out of debt.

Friend or Foe?

So, what is the real takeaway here?

Most people think of charge-offs in a very negative sense. Sure, it is a negative remark on a credit report. In all reality, though, it is more of a ‘matter-of-fact’ occurrence. By the time you have an account that reaches this point, it is probably no surprise that the debt is behind.

That is the real issue- the delinquency. Making a single payment to prevent that charge off is just a band-aid. You’ll still have the same struggle to deal with next month or on another account.

Rather than viewing the reference to a charge-off as a call to take action on that particular account, use it as a jumping-off point to work on bettering your entire financial situation.

Rather than attempting to prevent (or, more likely, delay) a single account from charging off, you will be better off making a plan to resolve all of your debts.

Easier Said Than Done?

Dealing with trouble debt and credit is hard. But, you don’t have to go it alone. We will lend a few suggestions, but always consider your unique big-picture to determine the best steps to reach your goals.

If you’ve just recently fallen behind, consider working with a reputable non-profit credit counseling agency. They can help you create a budget and make a plan to repay all of your debts.

We don’t want you just to read the attorney’s guide to reading a collection letter. We want you to take action.

If you are at the point of seeing your accounts charge off, you need a solution. This is an urgent situation, and you’ll want to create a plan of action to deal with the charge-off. The legal team at National Legal Center can assist you in doing exactly that.

One of the biggest focuses of the Attorney’s Guide to Reading a Collection Letter:

What Does ‘You have 30 days to dispute the validity of this debt’ Mean?

Collection letters come in all shapes and sizes.

They’re full of scary language and fine print. Or, maybe they say they’re on your side and want to be your friend. They may say the balance is due in full right away or that you must call their office to take advantage of some great offer. Sometimes they even have an entire second page with nothing but disclosures.

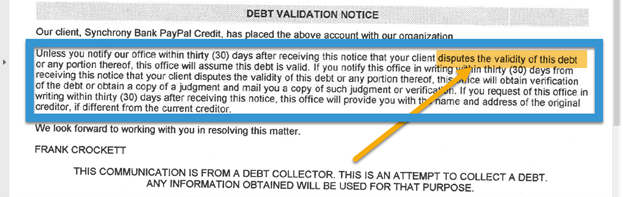

One of those disclosures, in particular, is very common. It usually accompanies the first letter a company sends after acquiring an account. This disclosure reads: “You have 30 days to dispute the validity of this debt.”

What does it mean?

What happens after 30 days?

Why are they giving that deadline?

What if you don’t do whatever it is they’re saying to do?

We’re going to dive in on all that and more.

This information is not just for clients enrolled in our Debt Resolution Legal Services but for anyone who needs to know how to read a debt collection letter. It shouldn’t take a legal degree to understand your consumer rights. We’re here to break it down for you so you can #standuptodebt, once and for all.

A Notice Of Your Rights

The first thing to know is that this is not a scare tactic.

People are sometimes concerned after reading this particular disclosure. They think that if they do not do this “thing,” they might be sued or face some other consequence.

The disclosure: “You have 30 days to dispute the validity of this debt.” is informing you of a right afforded to you under the Fair Debt Collections Practices Act (FDCPA). The wording may sound a bit doom-and-gloom because of that 30-day “deadline” that it seems to express. However, it is meant to help you!

Legal-Speak

According to the Federal Trade Commission, the particular provision of the FDCPA extending the right to dispute the validity of the debt is:

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or a copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

Yes. That is quite a run-on sentence.

Real Talk

This disclosure explains that under the FDCPA, you have the right as a person in debt to essentially say “this is not mine,” “I don’t believe I owe this,” or “that balance is not correct.”

If you do that within 30 days from the date you receive the collection letter, the collector should stop collecting until they validate the debt. That means they are not supposed to call, email, send letters or pursue other means of collection until they have provided you—the debtor— with proof of the debt.

There is so much upside there. Validating a debt can be a powerful tool for a person in debt, which is why it is one that debt settlement attorneys often use.

The Window Closes… Sort Of

Everything seems to center around this 30-day timeframe.

So, what happens after 30 days?

According to the Consumer Financial Protection Bureau, you can lose important rights if you do not act within the allotted time. Our experience shows that many reputable collection agencies and debt collectors will choose to stop collecting until they’ve provided validation of the debt, even if it is after the 30-day timeframe. However, as the CFPB points out, they are not likely under a legal obligation to do so.

It is always best to act within the timeframe specified under the FDCPA. However, if you do not believe the debt is valid, it may be worth disputing even if that window seems to have closed.

When To Send A Debt Validation Letter

The purpose of this provision of the FDCPA is to allow consumers to set the record straight. If you are receiving collection notices about a debt you don’t owe, this is your first chance to put it to rest. However, this right is not meant to get you out of debt that you legitimately owe.

Be mindful when disputing a debt- it could work against you.

The particular details of your situation will determine whether or not you should consider disputing a debt. For example, if you really do owe the debt, and you know you owe it, it may not be worth making the collector jump through the hoop of validating the debt.

Responding to their letter confirms a few things for them.

- you are alive

- they have the correct address

- you are aware of the debt

- the debt is bothering you

In addition to the information above, you have also forced them to gather statements and other documentation they may not have had to get. You’ve prompted them to put energy and expense into your debt.

Many of the documents needed to validate the debt also happen to be the same ones that assist a collector in filing a lawsuit to collect the debt.

So, again, be mindful.

What To Write In A Debt Validation Letter

The specific language one should use when writing a debt validation letter is specific to the details of the situation.

For example, our debt relief attorneys may send one letter when a balance seems different from what the client believes they owe. For example, we might send a different letter for a client who believes the debt was not theirs at all.

The CFPB provides several sample letters that can be quite useful.

For more specific guidance, speak with one of our knowledgeable Case Analysts to see how our debt settlement attorneys can help you.

What Will I Receive In Return?

If you are taking the time to write a letter to a collector, you might expect some sort of response. Per the FDCPA, their only requirement is to stop collecting until they can validate the debt. Assuming this is within that 30-day window, of course.

In some instances, they will send a letter confirming receipt of your request for debt validation. Beyond that, they should top collecting or send what they believe is proof.

A full validation will likely include credit card statements, a signed contract, and other documents to the effect.

Sometimes, they will send a haphazard letter or explanation claiming the debt is valid without giving much “proof.” In instances like this, our attorneys will often engage them through several rounds of communication. They may explain why they don’t believe the validation was accurate or thorough, among other approaches.

And sometimes, the collectors won’t respond at all.

They may genuinely cease collecting on the debt, conceding that they cannot prove that it is valid. In some instances, they may even send a letter confirming that they could not obtain appropriate documentation and will discontinue collecting the debt.

Well, What is a Debtor to Do?

As is so often the case, it depends.

Debt matters are so situational that attempting to provide a cookie-cutter response would be a disservice to you and a risk to your financial future.

Before sending a letter on your own:

- Arm yourself with all the information you can.

- Read more.

- Review example letters.

- Make sure you understand the specifics of your debt situation and how aggressive or consumer-friendly the collecting entity is.

Each item should help you decide whether or not to take action after reading that now not-so-scary disclosure- “You have 30 days to dispute the validity of this debt.”

Last, but not least, in the Attorney’s Guide to Reading a Collection Letter:

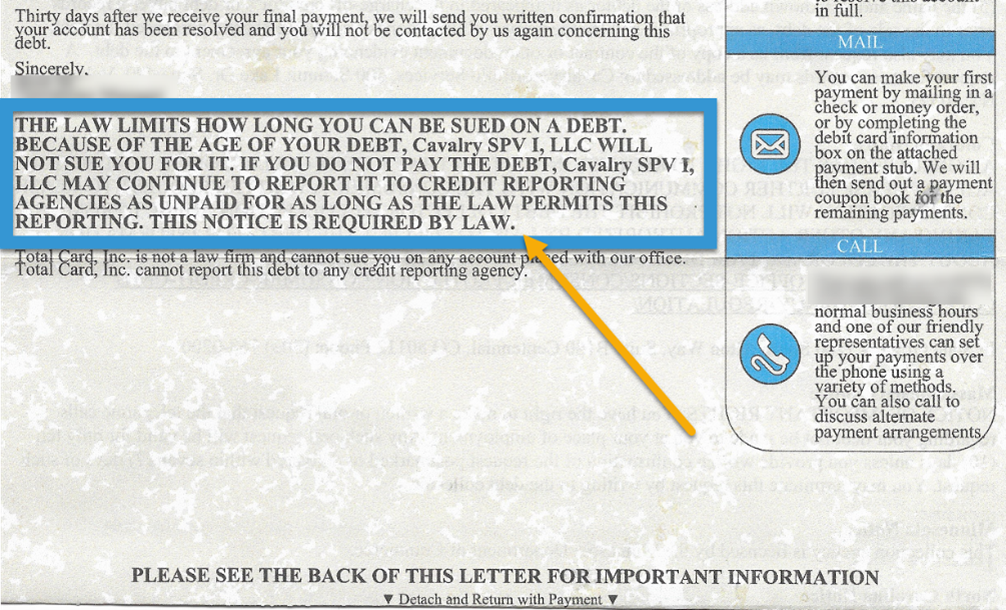

What Does ‘The law limits how long you can be sued on this debt’ Mean on a Collection Letter?

Sometimes it can be hard to tell what a collection letter is really trying to say. For example, is the collector sharing a notice that they are required to share by law? Or are they trying to frighten the reader into making a payment?

If you have ever come across the phrase “The law limits how long you can be sued on a debt” on a collection letter, it is crucial that you understand the meaning. This one sentence may entirely change the way you choose to deal with the account.

Simple Notice or Scare Tactic?

When this disclosure appears on a collection letter, it is most assuredly not a scare tactic.

It can be alarming to see any phrasing that refers to being sued, which sends many people into a bit of a panic. In this situation, though, the entire sentence and context is very important. They are explaining that they cannot, or will not, sue you because of how long the debt has gone unpaid.

So, this is a win!

Eliminating this risk takes away one of the biggest concerns of debt falling delinquent.

In some places, law dictates that collection agencies and other collecting entities tell debtors that they cannot sue them. This crucial factor allows the consumer to make informed decisions on how to deal with the debt.

The paragraph may include other vital points for you to be aware of. For example, they may also explain situations where they can regain the option to take legal action, such as when the debtor agrees to make a payment. So, be sure to read the letter closely. Sometimes it helps you understand what not to do!

What is a Statute of Limitations?

A statute of limitations is how long a person or entity has to take legal action against another person or entity for a grievance.

Statutes of limitations apply to many different situations. For example, it can come into play in criminal, corporate, or civil matters.

Generally, a collector will not sue on a debt that has passed the statute of limitations. However, there are times when they may still do so. When that happens, they may be unaware of the passing of the limitation, or they may be hoping that the consumer isn’t aware of their legal rights.

Suppose someone is sued after the statute of limitations has passed. In that case, the debtor then has a solid legal defense should a creditor take legal action against the individual.

State Laws Regarding Debt Collection

Regarding debt collection, some laws are established under federal laws, and others under state laws. For example, the FDCPA (Fair Debt Collection Practices Act) is established under federal law, whereas individual states determine the statute of limitations applicable under civil contract law.

Each state dictates its own statute of limitations regarding debt litigation. While the time frame generally falls around 5-6 years, there is a great deal of nuance from one state to the next and one type of debt to the next. For this reason, it is essential to review this legal matter with a debt attorney who is familiar with the laws of your state.

Examples of the nuance that often come up which can complicate the interpretation of the statute of limitations on a collection letter are:

- Did you move to a different state than when you opened the account?

- What state law did the original agreement say it would use?

- Has there ever been a lawsuit filed on this account before?

- Was this a revolving line of credit, like a credit card, an installment loan, or some other type of debt?

- Was there a co-borrower on the account?

- Did you agree to make a payment after initially falling behind?

- Did you actually make a payment after initially falling behind?

- In some locations, did you acknowledge that yes, you owe that debt in writing?

These are just a few examples of facts to consider when determining what it means when you see “The law limits how long you can be sued on a debt” on a collection letter.

There is a good chance that seeing that language on a collection letter means the collector should not file a lawsuit. However, it is imperative to speak with a licensed debt attorney to be sure. They will be able to help you interpret the document correctly and guide you on the next steps.

What Starts The Clock?

In many jurisdictions, the account starts counting down toward the statute of limitation when the last transaction occurred. That, of course, does leave plenty of gray area, which is why it is best to err on the side of caution.

Reviewing your credit report can help you identify the date the creditor reported to the credit bureaus as the last payment date, as well as when the account charged off.

Continued Implications

When you see “The law limits how long you can be sued on a debt” on a collection letter, a deep sigh of relief is warranted! This is because the legal risks on the account are likely much less when that statute has passed.

While this is wonderful news, it also helps to know that there are continued implications to having the debt remain outstanding.

Credit Report

When an account is delinquent, it will be reported to the credit bureaus as being behind. The statute of limitations does not have any tie to how long an account appears on your credit report.

Accounts generally remain on credit reports for seven years from the initial delinquency. So, even if you live in a state with a short statute—say three years—it will likely continue to appear in your credit report until the end of that seven-year time frame.

Collection Activity

In addition to appearing on your credit report, you may still experience collection activity on the account. Even if the collector cannot sue, they can call and send letters as long as they wish, up until you tell each new collector to stop in writing. An entire subset of the debt purchasing industry focuses on purchasing debt long past the statute of limitations.

If they continue calling and sending letters, your risks are not likely to change as long as you do not do something that resets the statute of limitations. Some ways you can unintentionally do this are by making a payment or even just a promise to make a payment on the debt in some states.

Speaking with a debt attorney will help you understand how to handle ongoing collection activity on post-statute accounts. In fact, several laws govern the collection of this kind of debt. Suppose they are not adhering to these regulations. In that case, you may be able to take action against them, possibly leading to your receiving money from the collector.

Financing Hurdles

If you are in the market for a home or a mortgage refinance, the debt may pose a hurdle to you. Sometimes they will require the borrower to resolve the debt even if it is past the statute of limitations.

You may have the option of settling the debt, or they may require that you pay the balance in full to complete the financing.

What to Do

Now that you understand what it means to see “The law limits how long you can be sued on a debt” on a collection letter, what’s next?

Sometimes inaction is the best strategy.

Suppose you confirm that the account is truly past the statute of limitations, congratulations! Aside from a pesky remark on your credit report and occasional letters or calls, you are not likely to have much more trouble with this account. Even if the account isn’t actually past the statute of limitations, save the letter. If the same collector later files suit you can produce that in court to show why the case should be dismissed, because you relied on their assertion.

Given that this is a state law with quite a bit of nuance, we suggest speaking with a debt attorney familiar with your state laws to ensure correct interpretation of the letter. The legal professionals at National Legal Center are glad to discuss your available options to help you move forward with confidence.

An Attorney’s Guide To Reading a Collection Letter

While we hope that this information and the resources provided are helpful and maybe even actionable, we do not want you to take it as legal advice.

If you have received a collection letter, don’t panic!

This is a letter. You can take your time to read it carefully and understand what you are being asked to do. And you should.

If you have any questions, please submit a request for a consultation or call our office. We can help read through the collection letter you’ve received. Become confident as you navigate the collections process with a law firm by your side. Reach out so we can stand up to debt, together!